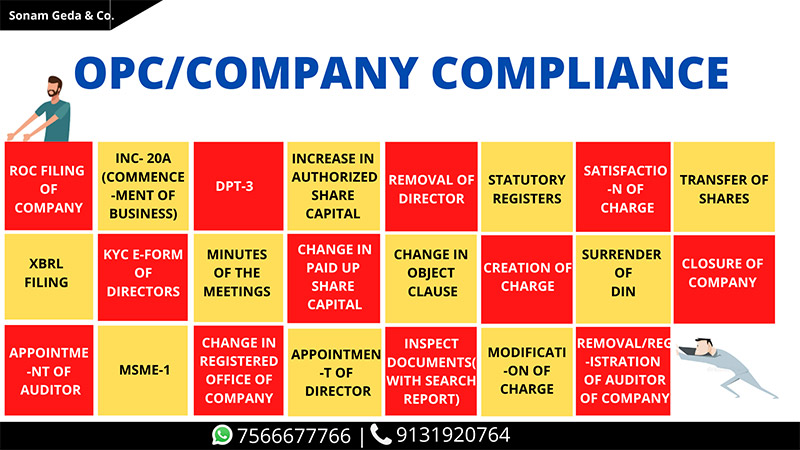

DPT-3 (Return of Deposit)

Overview

Company can raise funds through inviting deposits from its members or directors or general public. For the purpose of protecting interest of the deposit holder provisions are prescribed in the Companies Act and rules are made thereunder. Companies which accepts deposits are required to file return of deposit in form DPT-3 with the registrar every year providing status as on 31st march of the year.

CONDITIONS FOR ACCEPTING DEPOSITS BY THE COMPANY

- Pass special resolution for accepting deposits from general public.

- Appoint deposit trustee.

- Execution of deposit trust deed.

- Obtain credit rating for inviting deposits from public.

PROCEDURE OF FILING FORM DPT-3

- STEP-1: Prepare Books of Accounts: The Company should prepare its Books of Accounts and Financial Statements of the year and include in accounts correct amount of outstanding money or loan received which is not recognized as deposits as per rules. The accounts should be prepared according to accounting standards and principle of accounts.

- STEP-2: The annual accounts of the company once prepared and finalized should be audited by the statutory auditor of the company. The auditor will submit his audit report and will issue certificate certifying outstanding amount of money or loan received by the company in the prescribed manner.

- STEP-3: Download form: For filing return of deposits with the registrar download form DPT-3 from MCA portal.

- STEP-4: Filling form: The company shall fill in the required particulars of form and attach the required documents.

- STEP-5: Submission of form: After completing form in all respects digitally sign the form and submit the form with prescribed fees on the portal of MCA.

WAYS TO FILE DPT-3

- 1. One time return: This is for disclosure by company about details of outstanding money or loan received by it which is not considered as deposits according to the rules.

- 2. Annual return: It is return of deposits filed by the company every year on or before 30th June.

DUE DATE OF FILING DPT-3

Every company other than government company shall file return of deposits every year in form DPT-3 on or before 30th June showing status as on 31st March of the year.

Every company other than government company shall file one time return of outstanding money or loan received by it which is not considered as deposits according to the rules from 1st April, 2014 to 31st March, 2019 within 90 days from 31st March, 2019.

Government Fees

Fees in case of companies having share capital are:

| S.No. | Share Capital of the Company | Fee (in Rupees) |

|---|---|---|

| 1 | Less than 1,00,000 | 200 |

| 2 | 1,00,000 to 4,99,999 | 300 |

| 3 | 5,00,000 to 24,99,999 | 400 |

| 4 | 25,00,000 to 99,99,999 | 500 |

| 5 | 1,00,00,000 or more | 600 |

Fees in case of companies not having share capital: Rs.200

Penalty

Late filing of e-form will attract these penalty fees specified below:

| S.No. | Delay in Filing (No. of days) | Penalty |

|---|---|---|

| 1 | Up to 30 | 2 times of Normal Fees |

| 2 | More than 30 to 60 | 4 times of Normal Fees |

| 3 | More than 60 to 90 | 6 times of Normal Fees |

| 4 | More than 90 to 180 | 10 times of Normal Fees |

| 5 | More than 180 | 12 times of Normal Fees |

EXEMPTED COMPANIES

Following companies are not required to file form DPT-3:

- Government companies.

- Housing Finance Companies.

- Non-Banking Financial Companies.

ATTACHMENT OF DPT-3

- Auditors certificate.

- Copy of deposit trust deed.

- List of depositors.

- In case of secured deposits- copy of instrument creating charge.

CONSEQUENCES OF NON-FILING

In case of default in filing the company and officers of company who is in default shall be punishable with the penalty of Rs. 5000 and in case default continue Rs. 500 per day during the period of continuation of default.

What is e-form DPT-3?

E-form DPT-3 is used for filing return of deposits with the Registrar of Companies by every company other than government company accepting deposits.

What is the process of filing form DPT-3?

- STEP-1: Prepare Books of Accounts: The Company should prepare its Books of Accounts and Financial Statements of the year and include in accounts correct amount of outstanding money or loan received which is not recognized as deposits as per rules. The accounts should be prepared according to accounting standards and principle of accounts.

- STEP-2: The annual accounts of the company once prepared and finalized should be audited by the statutory auditor of the company. The auditor will submit his audit report and will issue certificate certifying outstanding amount of money or loan received by the company in the prescribed manner.

- STEP-3: Download form: For filing return of deposits with the registrar download form DPT-3 from MCA portal.

- STEP-4: Filling form: The company shall fill in the required particulars of form and attach the required documents.

- STEP-5: Submission of form: After completing form in all respects digitally sign the form and submit the form with prescribed fees on the portal of MCA.

What is due date of filing DPT-3 form?

Every company other than government company shall file return of deposits every year in form DPT-3 on or before 30th June showing status as on 31st March of the year.

Every company other than government company shall file one time return of outstanding money or loan received by it which is not considered as deposits according to the rules from 1st April, 2014 to 31st March, 2019 within 90 days from 31st March, 2019.

What are the consequences of non-filing of DPT-3?

If case of default in filing the company and officers of company who is in default shall be punishable with the penalty of Rs. 5000 and in case default continue Rs. 500 per day during the period of continuation of default.

What are the types of deposit return?

- 1. One time return: This is for disclosure by company about details of outstanding money or loan received by it which is not considered as deposits according to the rules.

- 2. Annual return: It is return of deposits filed by the company every year on or before 30th June.

What is the fee for filing DPT-3 form with Registrar?

Fees in case of companies having share capital are:

| S.No. | Share Capital of the Company | Fee (in Rupees) |

|---|---|---|

| 1 | Less than 1,00,000 | 200 |

| 2 | 1,00,000 to 4,99,999 | 300 |

| 3 | 5,00,000 to 24,99,999 | 400 |

| 4 | 25,00,000 to 99,99,999 | 500 |

| 5 | 1,00,00,00 or more | 600 |

Fees in case of companies not having share capital: Rs.200

Which documents are required for filing DPT-3 form?

- Auditors certificate.

- Copy of deposit trust deed.

- List of depositors.

- In case of secured deposits- copy of instrument creating charge.

Which companies are exempt from filing return of deposits in form DPT-3?

- Government companies.

- Housing Finance Companies.

- Non-Banking Financial Companies.

Can form DPT-3 be filed after due date?

Yes, return of deposits in form DPT-3 can be filed after due with the payment of below mentioned penalty.

Late filing of e-form will attract these penalty fees specified below:

| S.No. | Delay in Filing (No. of days) | Penalty |

|---|---|---|

| 1 | Up to 30 | 2 times of Normal Fees |

| 2 | More than 30 to 60 | 4 times of Normal Fees |

| 3 | More than 60 to 90 | 6 times of Normal Fees |

| 4 | More than 90 to 180 | 10 times of Normal Fees |

| 5 | More than 180 | 12 times of Normal Fees |

Subscribe Our Newsletter

Get useful latest news & other important update on your email.