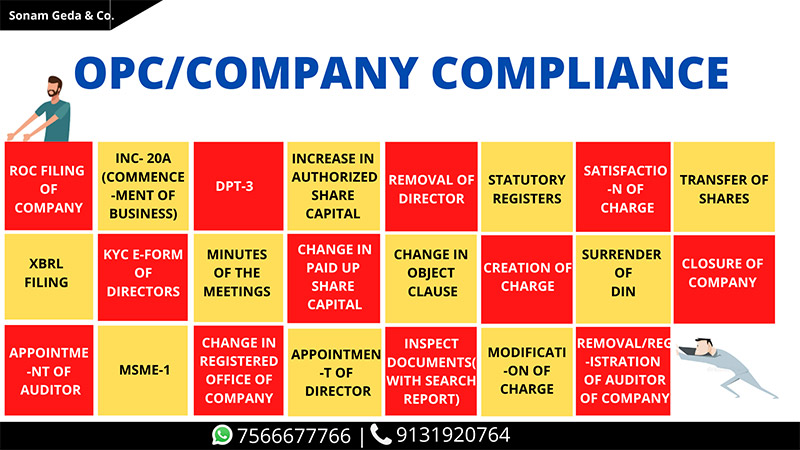

Modification of Charge

WHAT IS MODIFICATION OF CHARGES?

Modification of charge means changes in the terms and conditions or the extent or operation of any charge already registered with the Registrar of the Companies. As per the Companies act, 2013 provisions for registration of charge shall apply mutatis mutandis on the modification of charge.

TIME LIMIT FOR REGISTRATION MODIFICATION OF CHARGE

The charge modified by the company should be registered within 30 days of modification with the ROC. In case company fails to register within 30 days than it is required to make an application to:

- Registrar for extension of time in form CHG-1 along with the additional fees. The Registrar can extend time for not more than 300 days from the date of modification of charge. If company fails to register modification within 300 days than Registrar may allow to register modification within 6 months from the date of commencement of Companies (Amendment) Act, 2019. ( In case charges is created/modified before the commencement of Companies (Amendment) Act, 2019)

- Registrar for extension of time in form CHG-1 along with the additional fees. The Registrar can extend time for not more than 60 days from the date of modification of charge. If company fails to register modification within 60 days than Registrar may allow further period of 60 days after payment of fees. ( In case charges is created/modified on or after the commencement of Companies (Amendment) Act, 2019)

PROCEDURE FOR REGISTRATION OF MODIFICATION OF CHARGE

- STEP-1: Convene Board Meeting:- Board meeting of the company should be conducted after giving notice to the Board of Director to pass resolution for:

• Considering decision for modifying terms and conditions of charge.

• Authorising person to execute documents and filing application with registrar for registration of modification of charge. - STEP-2: Execute various documents for changing terms or conditions of loan and instrument evidencing modification of charge by the company with the Bank/ FI.

- STEP-3: Application for registration of modification of charge:- Company is required to make an application for registration of modification of charge within 30 days of modification of charge in form CHG-1 (for other than debenture) or in form CHG-9 (for debentures) with the ROC. The particulars of charge filed in form CHG-1 or CHG-9 shall be filed along with the prescribed fees and documents required shall be attached with this form.

- STEP-4: Application for condonation of delay:- If company fails to register modification charge within 30 days of its modification than it should apply ROC for the purpose of condonation of delay beyond 30 days in form CHG-1. The registrar on being satisfied may allow the company for registration of modification of charge within 300 or 60 days of modification as the case may be on payment of additional fees.

- STEP-5: Issue of certificate of Registration of Charge:- Where a modification of charge is registered by registrar, it will issue Certificate of Registration of Modification of charge in form CHG-3 to the company and to the person in whose favour charge is created.

WHAT PARTICULARS OF CHARGES SHOULD BE FILED?

The following particulars of charge should be filed with the Registrar:

- Total amount secured by the charge.

- Date and details of instrument creating charge.

- Name and address of charge holder.

- General description of the property charged.

- Date of resolution authorising creation of charge.

- Terms and conditions of the loan.

ATTACHMENTS OF FORM CHG-1

- Instrument of modification of charge.

- If company is acquiring property subject to charge then instrument evidencing modification of charge and acquisition of such property.

- If company has undertaken consortium finance than Particulars of all joint charge holders.

- optional attachments, if any.

E-FORMS FOR REGISTRATION OF MODIFICATION OF CHARGE

Following forms are required for registration of charge:

- CHG-1- Application by company for registration of modification of charge.

- CHG-3- Issue of Certificate of Registration of modification of charge by Registrar.

DOCUMENTS REQUIRED

Following Documents are required:

- Instrument of modification of charge

- DSC of Charge holder and Director

- DSC of CS

- PAN of the Charge holder

GOVERNMENT FEES

The fees for filing Form CHG-1 with the registrar of companies are:

| S.No | Share Capital of the Company (in Rupees) | Fee (in Rupees) |

|---|---|---|

| 1 | Less than 1,00,000 | Rupees 200 |

| 2 | 1,00,000 to 4,99,999 | Rupees 300 |

| 3 | 5,00,000 to 24,99,999 | Rupees 400 |

| 4 | 25,00,000 to 99,99,999 | Rupees 500 |

| 5 | 1,00,00,000 or more | Rupees 600 |

• In case of Indian company not having share capital- Rs. 200

• In case of foreign company- Rs. 6,000

| S.No | Delay in Filing (No of days) | Penalty |

|---|---|---|

| 1 | Upto 30 | 2 times of Normal Fees |

| 2 | More than 30 to 60 | 4 times of Normal Fees |

| 3 | More than 60 to 90 | 6 times of Normal Fees |

| 4 | More than 90 to 180 | 10 times of Normal Fees |

| 5 | More than 180 | 12 times of Normal Fees |

Subscribe Our Newsletter

Get useful latest news & other important update on your email.