Trust Registration

What is Trust?

As per the Indian Trust Act 1882, a Trust is an arrangement where the owner (trustor) transfers the property to someone else (trustee) for the benefit of a third person (beneficiary).

Such a property is transferred by the trustor to the trustee along with a proclamation that the trustee should hold the property for the beneficiaries of the Trust.

Kind of Trust (Type):

Trusts can be classified into two categories:

1. Public Trust

It is a trust whose beneficiaries include the public at large. Further, a Public Trust can be further subdivided into Public Charitable Trust and Public Religious Trust.

2. Private Trust

A private Trust is the one whose beneficiaries include families or individuals. Further, a Private Trust can be subdivided into:

• Private Trusts whose beneficiaries and their requisite shares both can be determined.

• The Private Trusts whose both or either the beneficiaries and their requisite shares cannot be determined.

Essential condition for formation of Trust

- The author of the trust whose declaration is clear and binding on him.

- There must be a transfer of the ownership by the author of the trust in favor of the trustee.

- A Trust property.

- The objects of the Trust must be concise and clearly specified.

- Once the trust gets closed, all the properties of the trust need to be donated to other trust and nothing can be held with the trustees.(n case of private trust)

Constitution of Trust

The Board of Trust constitutes the following:

- Author/Founder/Settlor of the trust:owner who transfers the property

- Managing trustee(s):transfer of the ownership by the author of the trust in favor of the trustee

- Beneficiary (Other trustees)-A person who is going to be benefitted by the formation of trust. Usually, Author himself is the Beneficiary or it is public at large.

Trust Deed

- A deed is optional for the formation of a trust. A trust can be formed by a deed or by an oral agreement. Whereas, it is advisable for trustshaving immovable property to have a trust deed. If in any circumstances, trust deed is not available,then documents such as revenue records for lands, property tax receipts, affidavits and other such documents may be considered for a substitute of registered trust deed.

- A Trust Deed is legal evidence of Trust’s existence and contains the rules and regulations & bylaws regarding the changes, removal or addition of the Trustees.

- The Trust deed includes the following clauses:

• Name of the trust

• The registered office of the trust

• Area of operation of the trust

• Objectives of the trust

• Details of the Author of the Trust

• Corpus/Assets of the Trust

• Details of the Board of Trustees

• Quorum of the Board with their qualification, terms and tenure

• Powers and functions of the Managing Trustee and other Trustees

• Closure and amendment of the trust deed and the applicability of the Act

Taxation for Trust Registration

Under the Income Tax Act for availing the exemptions , Trust is needed to get the registered trust deed and more over a deed is a essential and important evidence of the existence of a trust.

A trust, like any other legal entity, is liable to pay tax. In order to be exempted from tax, trust is required to obtain certification for the said exemptions such as Section 12 A, 80G etc. from the Income Tax authorities.

Procedure for Trust Registration

- To register a charitable trust, an application for Trust registration must be made to the official having jurisdiction in the state for Trust registration. The application for Trust registration must include details like Trust name, names of Trustees, mode of succession, etc.,

- The application must include a court fee stamp and a nominal Trust registration fee, which varies depending on the Trust property and the State of registration. The application must include a certified copy of the Trust deed as0020well.

- The trust registration form once prepared must be signed by the applicant in the presence of the Regional Officer or Superintendent of the Regional Office of the Charity Commissioner or a Notary.

- After submitting the Trust Deed with the registrar, the registrar retains the photocopy and returns the original registered copy of the Trust Deed.

- Then, after completing all the formalities registration certificate is issued.

Document Required for Trust Registration

- The details of trustees like Name, Occupation, Address, Age, Father’s Name, Designation, Mobile Number, Email Address and Two Photograph are required.

- Address Proof of Trustee & Settler required: – Voter I.D / Driving license / Passport.

- Electricity Bill or House Tax Receipt or Water Bill Receipt or Ownership Proof of Property required.

- In the case of Rented, Rent Deed duly notarised with rent receipt and NOC form Land Lord on Stamp Paper, Name of Landlord, Father’s name, Residence Address.

- Physical Presence of Settler/all required at the time of Registration along with Original ID.

- Physical Presence of Two witnesses with original ID Proof at the time of Registration.

- Covering letter for Trust registration to the Official having Jurisdiction

- Application for trust registration

- Certified copy of Trust deed on stamp paper

- Consent letter of Trustees

Compliance of Trust Registration

- PAN of trust

- Income tax return filing

- Audit of Trust (if any)

- Accounting & Book Keeping of trust.

What is Trust?

As per the Indian Trust Act 1882, a Trust is an arrangement where the owner (trustor) transfers the property to someone else (trustee) for the benefit of a third person (beneficiary).

Such a property is transferred by the trustor to the trustee along with a proclamation that the trustee should hold the property for the beneficiaries of the Trust.

What is Types of Trust?

Kind of Trust (Type):

Trusts can be classified into two categories:

1. Public Trust

It is a trust whose beneficiaries include the public at large. Further, a Public Trust can be further subdivided into Public Charitable Trust and Public Religious Trust.

2. Private Trust

A private Trust is the one whose beneficiaries include families or individuals. Further, a Private Trust can be subdivided into:

• Private Trusts whose beneficiaries and their requisite shares both can be determined.

• The Private Trusts whose both or either the beneficiaries and their requisite shares cannot be determined.

What are the essential conditions for formation of Trust?

- The author of the trust whose declaration is clear and binding on him.

- There must be a transfer of the ownership by the author of the trust in favor of the trustee.

- A Trust property.

- The objects of the Trust must be concise and clearly specified.

- Once the trust gets closed, all the properties of the trust need to be donated to other trust and nothing can be held with the trustees.(n case of private trust)

What is Trust Deed?

- A deed is optional for the formation of a trust. A trust can be formed by a deed or by an oral agreement. Whereas, it is advisable for trustshaving immovable property to have a trust deed. If in any circumstances, trust deed is not available,then documents such as revenue records for lands, property tax receipts, affidavits and other such documents may be considered for a substitute of registered trust deed.

- A Trust Deed is legal evidence of Trust’s existence and contains the rules and regulations & bylaws regarding the changes, removal or addition of the Trustees.

- The Trust deed includes the following clauses:

• Name of the trust

• The registered office of the trust

• Area of operation of the trust

• Objectives of the trust

• Details of the Author of the Trust

• Corpus/Assets of the Trust

• Details of the Board of Trustees

• Quorum of the Board with their qualification, terms and tenure

• Powers and functions of the Managing Trustee and other Trustees

• Closure and amendment of the trust deed and the applicability of the Act

What are the steps involved in formation of Trust?

- To register a charitable trust, an application for Trust registration must be made to the official having jurisdiction in the state for Trust registration. The application for Trust registration must include details like Trust name, names of Trustees, mode of succession, etc.,

- The application must include a court fee stamp and a nominal Trust registration fee, which varies depending on the Trust property and the State of registration. The application must include a certified copy of the Trust deed as0020well.

- The trust registration form once prepared must be signed by the applicant in the presence of the Regional Officer or Superintendent of the Regional Office of the Charity Commissioner or a Notary.

- After submitting the Trust Deed with the registrar, the registrar retains the photocopy and returns the original registered copy of the Trust Deed.

- Then, after completing all the formalities registration certificate is issued.

What is the constitution of Trust?

The Board of Trust constitutes the following:

- Author/Founder/Settlor of the trust:owner who transfers the property

- Managing trustee(s):transfer of the ownership by the author of the trust in favor of the trustee

- Beneficiary (Other trustees)-A person who is going to be benefitted by the formation of trust. Usually, Author himself is the Beneficiary or it is public at large.

What is the provision of income tax for trust?

Under the Income Tax Act for availing the exemptions, Trust is needed to get the registered trust deed and more over a deed is an essential and important evidence of the existence of a trust.

A trust, like any other legal entity, is liable to pay tax. In order to be exempted from tax, trust is required to obtain certification for the said exemptions such as Section 12 A, 80G etc. from the Income Tax authorities.

What are the compliances for Trust registration?

- PAN of trust

- Income tax return filing

- Audit of Trust (if any)

- Accounting & Book Keeping of trust.

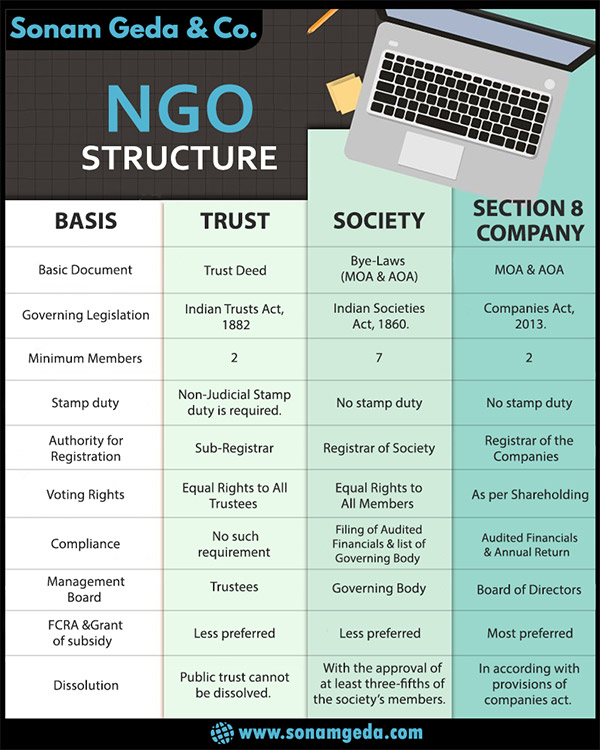

What is difference between Trust and different form of organisation?

We have prepared a detailed and easy to understand comparative table showing availability of features and advantages of one form of business to that of others. The same can be found at the end of this page.