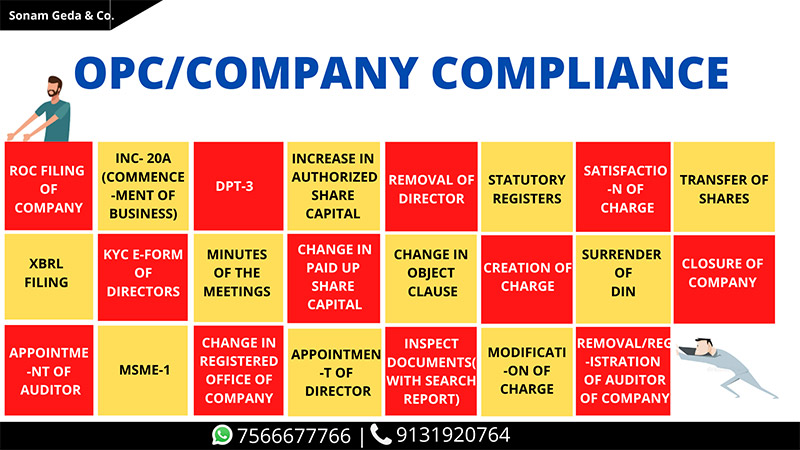

Increase in Authorized Share Capital

Overview

A company can change structure of its share capital only if it is authorised by the articles. The change in share capital of company can be effected in various ways which are mentioned below.

PROCEDURE FOR ALTERATION OF SHARE CAPITAL

- STEP 1 - Check authority :Check that the articles of the company authorise it to make changes in the share capital of the company.

- STEP 2 - Convene Board Meeting : Meeting of Board of Directors of the company is to be conducted to pass resolution for:

• Approving the proposed changes in the share capital of the company.

• Approving notice of general meeting and fixing time, date and venue of the general meeting for passing special resolution.

• Authorising person to issue notice of general meeting on behalf of the board. - STEP 3 - Hold General Meeting : The general meeting of the company should be hold after giving 21 days clear notice to the members for passing resolution to alter share capital of the company.

- STEP 4 - Filing with Registrar : A Company shall file form SH-7 within 30 days of passing resolution for alteration of share capital along with the requisite fees and required documents.

- STEP 5 - Amendment in the MoA and AoA : Alteration in the MoA and AoA shall be made or alternatively company can print fresh copies of it after successful submission of the form.

WAYS OF ALTERATION OF SHARE CAPITAL

The share capital of the company can be altered in any of the following manners:

- By consolidating shares of the company into shares of larger amount.

- By sub-dividing shares into smaller amount shares.

- By increasing authorised share capital of the company.

- By converting shares of company into stock or vice versa.

- By cancelling shares which is not taken by anyone.

IN CASE ARTICLES DO NOT AUTHORISE TO ALTER SHARE CAPITAL

If the Articles of the company do not authorise to alter the share capital of the company then company is required to alter the articles first. For the purpose of alteration of articles company shall pass special resolution in the general meeting. After passing special resolution form MGT-14 is to be filed within 30 days of passing resolution along with the copy of special resolution and altered copy AoA.

FORMS TO BE FILED

- SH-7: Notice to the Registrar about alteration of share capital by company.

- MGT-14: filing of special resolution with the Registrar by the company.

ATTACHMENTS

- Altered copy of MoA and/or AoA.

- Copy of resolution passed in general meeting.

- Notice of general meeting.

- Copy of Board Resolution.

Subscribe Our Newsletter

Get useful latest news & other important update on your email.