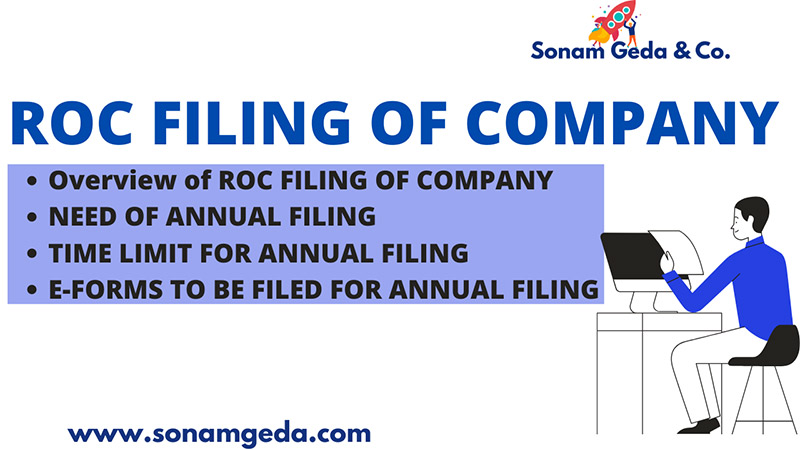

ROC Filing of Company

Overview

Every company incorporated under the Companies Act, 2013 is required to do annual filings with the Registrar of Companies. In this annual filings company is required to file its financial statements and annual return with the registrar in prescribed form.

NEED OF ANNUAL FILING

Annual filing is required for:

- Reporting to the registrar.

- Maintaining transparency in company’s operation.

- Creating credibility and trust ability for banks and the government.

- Avoiding penalties of non-filing.

TIME LIMIT FOR ANNUAL FILING

- The company is required to file its financial statements within 30 days of the date of AGM. But OPC is required to file its annual accounts within 180 days from the closure of financial year.

- Every company is required to file their annual return within 60 days of the date of AGM of the company.

- Where the AGM of the company is not held then the financial statement along with the statement of facts and reasons of not conducting AGM shall be filed with the registrar within 30 days from the last date on or before which the AGM of the company should have been held.

PROCEDURE OF ANNUAL FILING

- STEP-1: Preparation Books of Accounts: As per the Companies Act, 2013 every company is required to prepare its Books of Accounts and Financial Statements every year. The accounts should be prepared according to accounting standards and principle of accounts.

- STEP-2: Approval of accounts by Board: The annual accounts so prepared shall be approved by the board of directors in duly convened board meeting. After approval of accounts it is to be submitted to statutory auditor of the company for his report.

- STEP-3: Statutory Audit: The annual accounts of the company once prepared and finalized should be audited by the statutory auditor of the company and he will submit his audit report.

- STEP-4: Adoption of annual accounts in AGM: The approved annual audited accounts and report of auditor and directors of the company shall be placed in the annual general meeting for its adoption by the member of the company. For the purpose of holding AGM of the company above mentioned documents along with the notice of AGM shall sent to the members of the company at least clear 21 days before the date of the meeting.

- STEP-5: Adopted annual accounts of the company shall be filed with the registrar within 30 days of the date of meeting i.e. AGM in form AOC-4 along with the prescribed fees and documents.

- STEP-5: Filing of annual return: The company shall within 60 days from the date of AGM file annual return of the company in form MGT-7 with the registrar along with prescribed fees and documents. Annual return contains details of the share capital, directors, changes in directors, KMP, indebtedness, shareholding pattern, promoter, meetings, security holders of the company. It shows overall standing of the company.

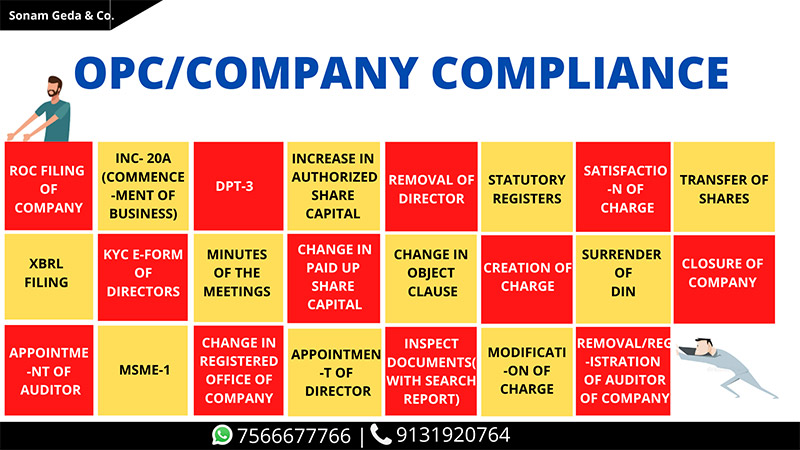

EVENT BASED FILING WITH ROC

There are some events mentioned below in which company is required to file it with registrar:

- Appointment or resignation of auditor.

- Appointment of Key Managerial Personnel.

- Appointment or resignation of directors.

- Changes in:

o Paid-up share capital.

o Registered office.

o Authorized share capital.

o Object.

o Name of the company. - Acceptance of deposits by the company.

E-FORMS TO BE FILED FOR ANNUAL FILING

- AOC-4: Filing of financial statement by the company with registrar.

- AOC-4 CFS: Filing of consolidated financial statement by the company with registrar, in case company is having consolidated financial statement.

- MGT-7: Filing of Annual Return by the company with registrar.

- MGT-9: Filing of abstract of financial statement by the company with registrar.

DOCUMENTS REQUIRED

Following Documents are required:

- Boards report.

- Auditors report.

- CSR report.

- Financial statement.

- List of shareholders and other security holders.

- Corporate Governance report.

- DSC of the director authorized to sign forms.

GOVERNMENT FEES

Fees for filling of compliances for companies having share capital:

| S.No. | Nominal Share Capital (In Rupees) | Fees (In Rupees) |

|---|---|---|

| 1 | Less than 1,00,000 | Rupees 200 |

| 2 | 1,00,000 to 4,99,999 | Rupees 300 |

| 3 | 5,00,000 to 24,99,999 | Rupees 400 |

| 4 | 2500000 to 99,99,999 | Rupees 500 |

| 5 | 10000000 or more | Rupees 600 |

For company not having share capital- Rs. 200.

What is ROC filing?

Every company incorporated under the Companies Act, 2013 is required to do annual filings with the Registrar of Companies. In this annual filings company is required to file its financial statements and annual return with the registrar in prescribed form.

Why Annual Filing is required?

Annual filing is required for:

- Reporting to the registrar.

- Maintaining transparency in company’s operation.

- Creating credibility and trust ability for banks and the government.

- Avoiding penalties of non-filing.

What is time limit of annual filing with ROC?

- The company is required to file its financial statements within 30 days of the date of AGM. But OPC is required to file its annual accounts within 180 days from the closure of financial year.

- Every company is required to file their annual return within 60 days of the date of AGM of the company.

- Where the AGM of the company is not held then the financial statement along with the statement of facts and reasons of not conducting AGM shall be filed with the registrar within 30 days from the last date on or before which the AGM of the company should have been held.

What forms are required to be filed?

- AOC-4: Filing of financial statement by the company with registrar.

- AOC-4 CFS: Filing of consolidated financial statement by the company with registrar, in case company is having consolidated financial statement.

- MGT-7: Filing of Annual Return by the company with registrar.

- MGT-9: Filing of abstract of financial statement by the company with registrar.

What is the process of Annual filing?

- STEP-1: Preparation Books of Accounts: As per the Companies Act, 2013 every company is required to prepare its Books of Accounts and Financial Statements every year. The accounts should be prepared according to accounting standards and principle of accounts.

- STEP-2: Approval of accounts by Board: The annual accounts so prepared shall be approved by the board of directors in duly convened board meeting. After approval of accounts it is to be submitted to statutory auditor of the company for his report.

- STEP-3: Statutory Audit: The annual accounts of the company once prepared and finalized should be audited by the statutory auditor of the company and he will submit his audit report.

- STEP-4: Adoption of annual accounts in AGM: The approved annual audited accounts and report of auditor and directors of the company shall be placed in the annual general meeting for its adoption by the member of the company. For the purpose of holding AGM of the company above mentioned documents along with the notice of AGM shall sent to the members of the company at least clear 21 days before the date of the meeting.

- STEP-5: Adopted annual accounts of the company shall be filed with the registrar within 30 days of the date of meeting i.e. AGM in form AOC-4 along with the prescribed fees and documents.

- STEP-5: Filing of annual return: The company shall within 60 days from the date of AGM file annual return of the company in form MGT-7 with the registrar along with prescribed fees and documents. Annual return contains details of the share capital, directors, changes in directors, KMP, indebtedness, shareholding pattern, promoter, meetings, security holders of the company. It shows overall standing of the company.

Which documents are required for Annual filing?

- Boards report.

- Auditors report.

- CSR report.

- Financial statement.

- List of shareholders and other security holders.

- Corporate Governance report.

- DSC of the director authorized to sign forms.

What is the fees of ROC filing?

Fees for filling of compliances for companies having share capital:

| S.No. | Nominal Share Capital (In Rupees) | Fees (In Rupees) |

|---|---|---|

| 1 | Less than 1,00,000 | Rupees 200 |

| 2 | 1,00,000 to 4,99,999 | Rupees 300 |

| 3 | 5,00,000 to 24,99,999 | Rupees 400 |

| 4 | 2500000 to 99,99,999 | Rupees 500 |

| 5 | 10000000 or more | Rupees 600 |

For company not having share capital- Rs. 200.

Subscribe Our Newsletter

Get useful latest news & other important update on your email.